irs child tax credit problems

For parents of children up to age five the IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit. Have been a US.

Some Undocumented Immigrants Aren T Getting Their Child Tax Credit Payments Marketplace

By Joe Bishop-Henchman January 28 2022.

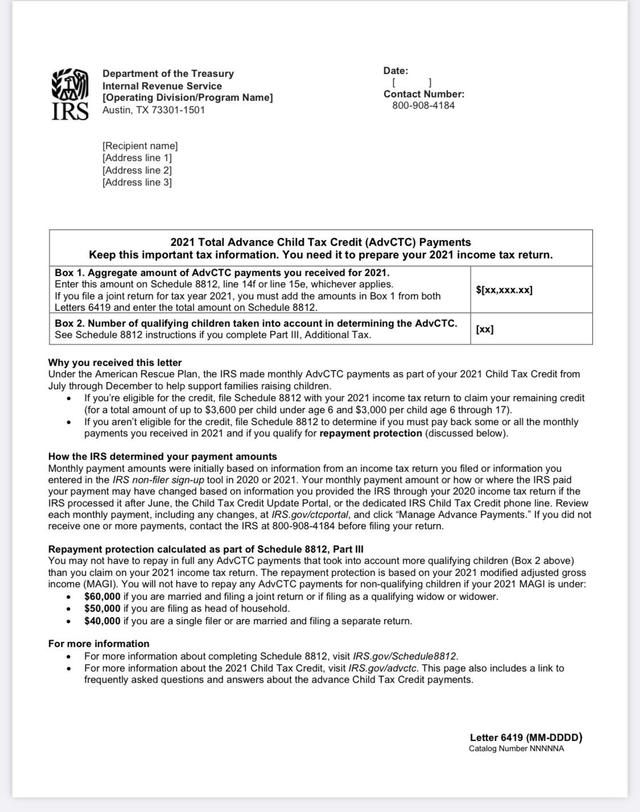

. September 24 2021. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. They say its causing stress and.

Contact the IRS as soon as possible from 7 am. We have resolved a. To reconcile advance payments on.

Two days after the child tax credit was supposed to be direct-deposited many parents report they have not received it and have not been updated by the IRS. If you have children and received child tax credit payments in. That comes out to 300 per month and 1800.

Many families received advance payments of the Child Tax Credit in 2021. The Child Tax Credit Update Portal is no longer available. Starting 15 July the agency will begin sending out monthly advance payments for the 2021 Child Tax Credit.

The IRS is taking on a new challenge. July 15 2021 Topic. HOUSTON - Many people continue to have problems receiving their child tax credit payments or have received math error notices from the IRS.

IRS Admits Errors in Child Tax Credit Letters Sent to Taxpayers. Last week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits totaling 15 billion. You can see your advance payments total in.

Find answers about advance payments of the 2021 Child Tax Credit. The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds. IThe IRS phone lines are expected to continue to be jammed and difficult to get through Rettig said on the call Monday.

Child Tax Credit Families Income Inequality IRS Pandemic Recovery. These updated FAQs were released to the public in Fact Sheet 2022-32PDF July 14 2022. This will allow you to claim if eligible the missing payment with your Child Tax Credit on your 2021 return.

150000 if married and filing a joint return or if filing as a qualifying. Why it matters. One problem could be inaccurate or outdated information on your 2020 tax return.

The IRS is expected to send out the first advance child tax credit payment to millions of American families in roughly two weeks as part of President Joe Bidens 19 trillion. The IRS announced a technical issue that could affect up to 15 percent of recipients of the Child Tax Credit. More than 9 million Americans did not claim the payments and may be eligible for the 2021 Recovery Rebate Credit the Child Tax Credit and the Earned Income.

Child Tax Credit Problem. A group of parents who received their July payment via. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

With the IRS sending out millions of child tax. Or perhaps the IRS doesnt know youre eligible. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

Child Tax Credit Blog Brand. Last year the IRS received more than 100 million.

What Can I Do If I Didn T Get My Child Tax Credit Payment

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Stimulus Payments Triggered Millions Of Irs Math Error Notices

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Child Tax Credit Payments 2021 Who Is Eligible And How Much Are They Wsj

Expanded Child Tax Credit Available Only Through The End Of 2022 Cbs Los Angeles

Fixing What Wasn T Broken Why Biden S Child Tax Credit Scheme Is A Recipe For Failure

Child Tax Credit Will The Irs Have Problems Sending Out Monthly Checks Cbs Philadelphia

Irs Warns Some Taxpayers May Have Received Incorrect Child Tax Credit Letter 6419 Cbs News

Surprise You May Owe The Irs Money Because Of A Math Error Poynter

Here S How To Avoid An Advanced Child Tax Credit Scam Itrc

Fearing Filing Season Chaos Irs Hits Pause On Web Tool For Child Tax Credit Politico

Democrats Further Effort To Expand Child Tax Credit For Pandemic Relief

How The New Expanded Federal Child Tax Credit Will Work

Claim Child Tax Credit With Irs Form 8812 Thestreet

Summary Of Eitc Letters Notices H R Block

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Don Moynihan On Twitter Not Great Usability Feedback On The New Irs Tool To Help Lowest Income Earners Get The Child Tax Credit Have To Ask Why Intuit Is Doing This Given